The Brazilian games industry in numbers

To kickstart our Brazil Games Week, we’re aiming to provide as precise a picture as possible of the Brazilian ecosystem.

GamesIndustry.biz’s James Batchelor travelled to Brazil earlier this year, and you can read his overview of the market, its challenges and opportunities, on this page – directly from the professionals who are part of it.

Meanwhile, over here, we’ll look through the numbers that make the Brazilian games industry, its market, and its audience.

The figures and stats presented below are from the second national survey of the games industry by the Brazilian Association of Digital Game Developers (Abragames) and the Brazilian Agency for Promotion of Exports and Investments (ApexBrasil), which takes into account 2022 data previously collected, and new figures gathered in 2023 by GA Consulting.

343 companies contributed to the Game Brasil Survey, representing about 33% of the total number of studios in Brazil.

Compared to previous surveys, this new research showed significant growth across the board for the Brazilian industry.

The Brazilian games industry

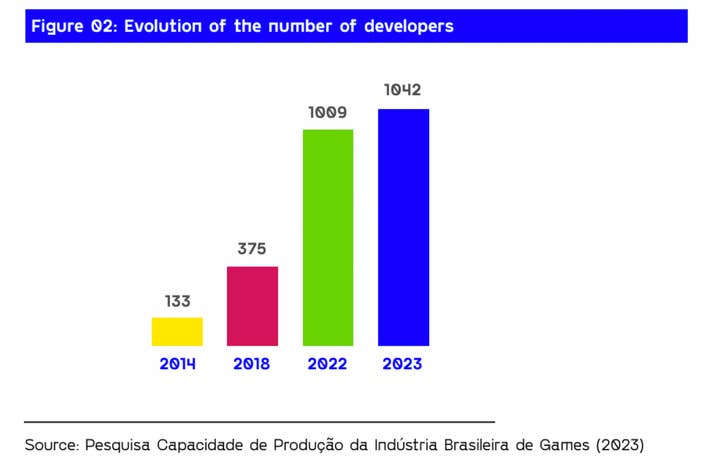

The games industry in Brazil is mainly made up of micro and small studios, for a total of 1,042 developers. 2,600 Brazil-made games released between 2020 and 2022 (with 1,009 launched in 2022 alone, representing a 12% rise year on year).

The evolution compared to 2014 and the very first survey of the Brazilian games industry is quite striking, as at the time there were only 133 studios. In 2018, that number had grown to 375, showing a 177% increase from then to 2023.

As of last year, there were 13,225 professionals working in the Brazilian games industry, a 6.3% increase compared to 2022’s 12,441.

The industry in Brazil is dominated by men, who represented 74.2% of the workforce at the studios surveyed. The number of women decreased from 2022 to 2023, from 29.8% to 24.3%. The number of non-binary workers remained steady at 1.5%.

“One explanation for the reduction in the number of women between the two years is the sampling effect, as the responding companies in the two surveys are different,” the survey noted.

93% of the Brazilian studios surveyed are working on their own IP.

“Currently, the projects from our studios are on par with those of the same size from any other part of the world,” commented Rodrigo Terra, president of Abragames. “There is still a clear difference in investment, but not due to a capacity issue.

“From 2021 to 2022, for example, it was observed that the participation of national studios in transmedia projects (15%) and licensing their own IPs (13%) surpassed the involvement in licensing third-party products (10%) – which represented 18% in 2021.”

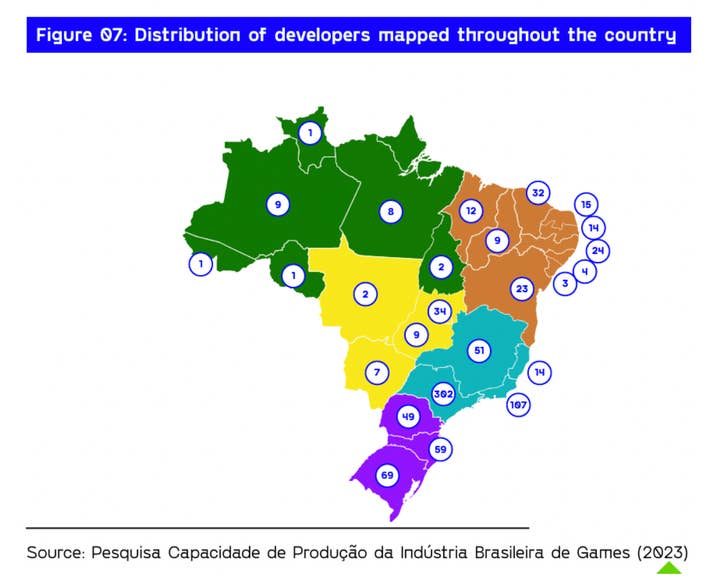

Looking at where studios are established across Brazil, an impressive number are located in Sao Paulo (302), followed by Rio de Janeiro (107), and Rio Grande de Sol (69).

70% of Brazilian studios operate remotely, followed by 16% opting for a hybrid system, and only 14% in an office setting.

Finally, looking at the tech that Brazilian studios use, 80% of respondents said they use Unity to develop their games, followed by Unreal engine at 25% (indicating that some studios may be using both).

The Brazilian games market

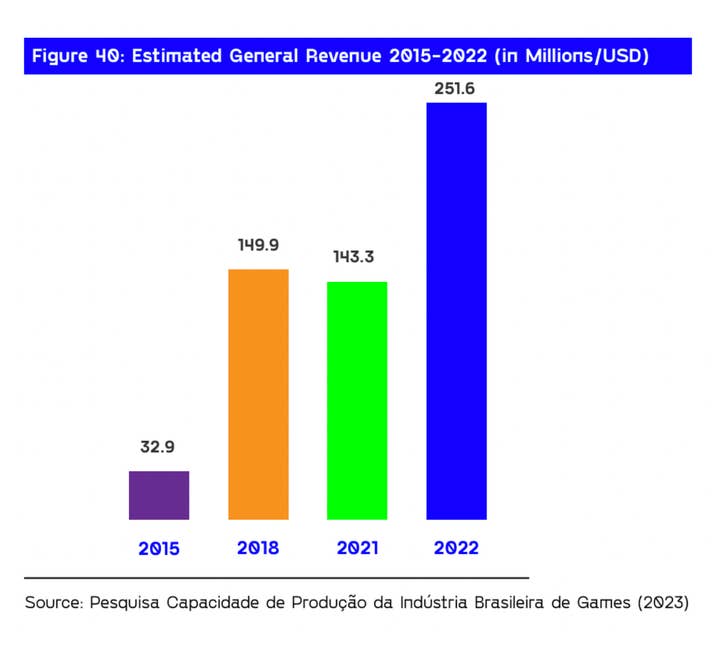

The Game Brasil Survey estimated that revenue from the game development industry in Brazil reached USD $251.6 million in 2023.

According to the survey, mobile accounts for 51.7% of the Brazilian market, followed by console at 20.5% and PC at 19.4% – consoles only recently overtook PC between 2022 and 2023, a time during which mobile also grew 3.4%.

However, looking at Brazill-made games, it contrasts with what players actually buy in the country. Only 24% of titles developed in Brazil are for mobile, slightly behind PC games at 24.9%. They are followed by web browser games at 23%, and consoles at 11%.

Digital sales in Brazil increased from 54% of all game sales in 2021, to 62% in 2023.

Looking at the types of games made in Brazil, entertainment titles represented a vast majority at 83%, followed by educational games at 8%, and ‘advergames’ at 3%.

Many of Brazil’s studios, particularly the larger ones, offer work-for-hire services for other developers overseas. The rest of Latin America and the United States are the most prominent commercial partners of Brazil for games. But Western Europe is on the rise with 54% of Brazilian game studios now doing business with that region, versus 49% in 2023.

About half of the studios doing business internationally obtained over 70% of their revenue from abroad.

The Brazilian audience

Brazil is the largest games market in Latin America, and the fifth biggest globally in terms of online population with an estimated 103 million players.

The Game Brasil Survey showed that around 82.1% of Brazilians say that playing video games is one of their main forms of entertainment.

Women represent around 46.2% of players in Brazil, versus 53.8% for men.

Age groups are all fairly equally represented when it comes to the audience, with a majority of players being between 19-years-old and 44-years-old. The dominant age group is between 25 and 29, representing 16.2% of the players, followed closely by 30 to 34-years-old at 16.1%.

The survey noted a slight increase in the over-50 age group, up 2% to represent 8.5% of the Brazilian audience.

A big portion of players in Brazil identify as white (42.2%), very closely followed by mixed race (41.4%, a 4.1% growth year on year), and Black at 12.7%.

Looking ahead, Rodrigo Terra is optimistic about Brazil’s momentum, saying: “We are going through a new moment, as there is a post-pandemic reorganisation of companies and market expectations are still relative.

“However, there are prospects for improvement in the Brazilian economy, supported by a more stable political environment, contrasting with the instability of the global market. We believe in a future with potential opportunities and many challenges, where Brazil can stand out with an ecosystem that has been growing and diversifying more and more.”

Source link : Gamesindustry